941 Irs Form 2024. 10 by the internal revenue service. The irs finalized form 941 and all schedules and instructions for 2024.

Irs form 941, also known as the employer’s quarterly federal tax return, is where businesses report the income taxes and payroll taxes that they withheld from their employees’ wages — as well. Page last reviewed or updated:

First Quarter Deadline — April 30, 2024 (January, February, And March) Second Quarter Deadline — July 31, 2024.

Rock hill, sc / accesswire / april 29, 2024 / the next business day, april 30, 2024, marks the deadline for employers to.

The Revision Is Planned To Be Used For All Four Quarters.

Page last reviewed or updated:

Social Security Wage Limit Updated.

Images References :

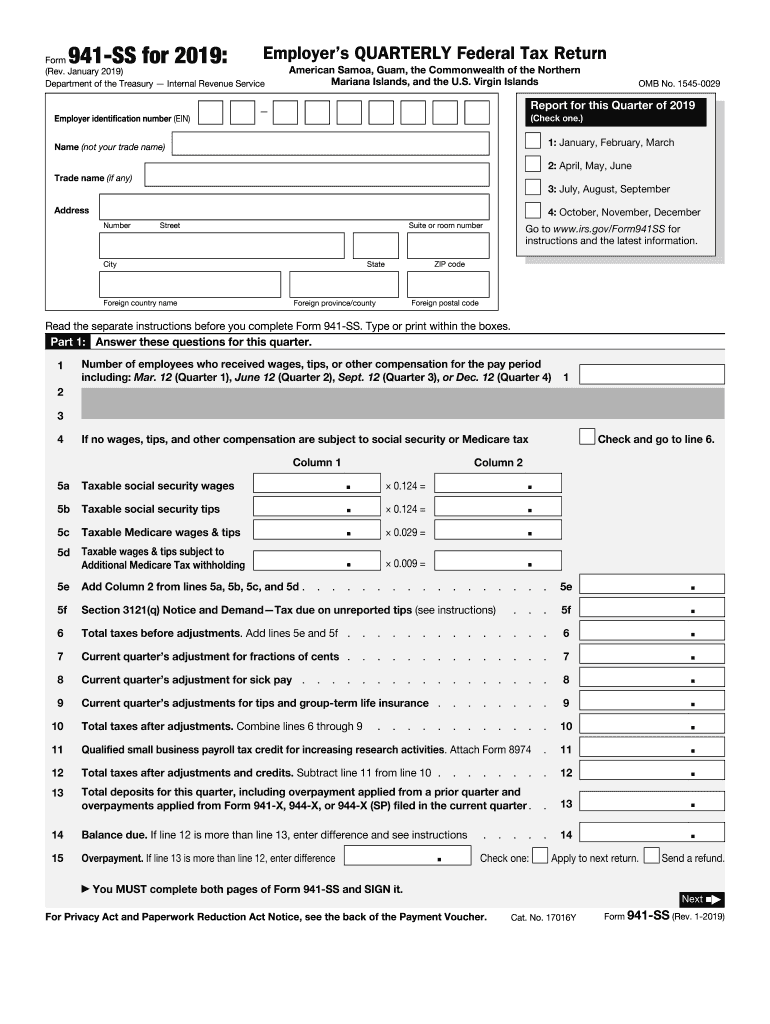

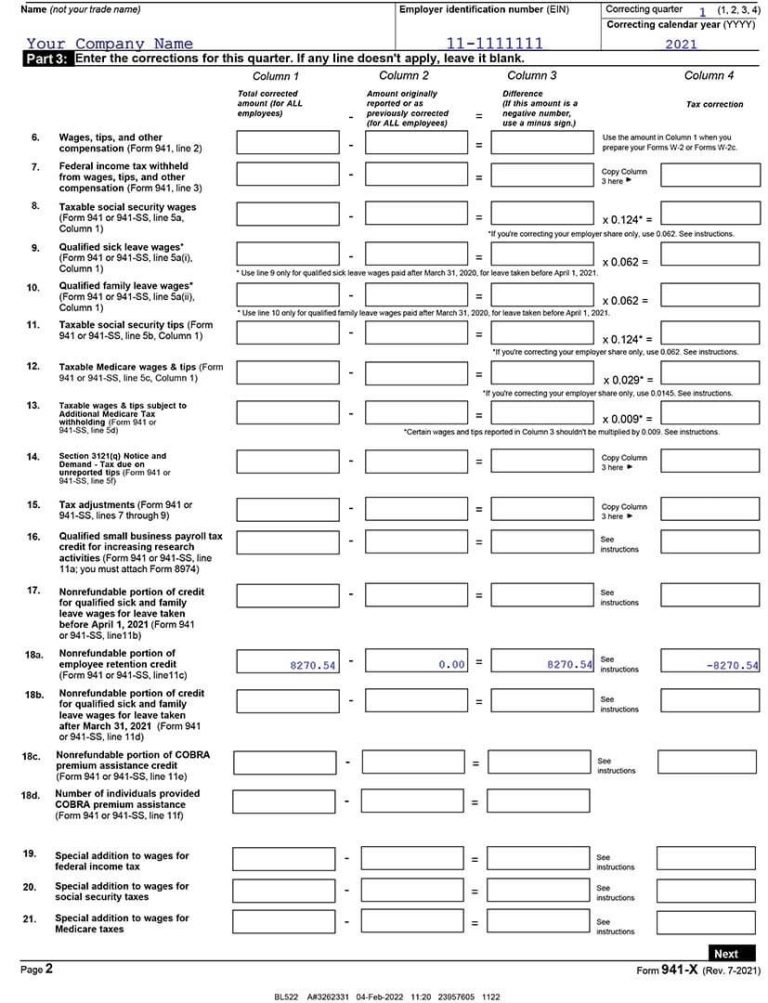

Source: www.dochub.com

Source: www.dochub.com

941 irs Fill out & sign online DocHub, What are the changes to form 941 for 2024? Social security wage limit updated.

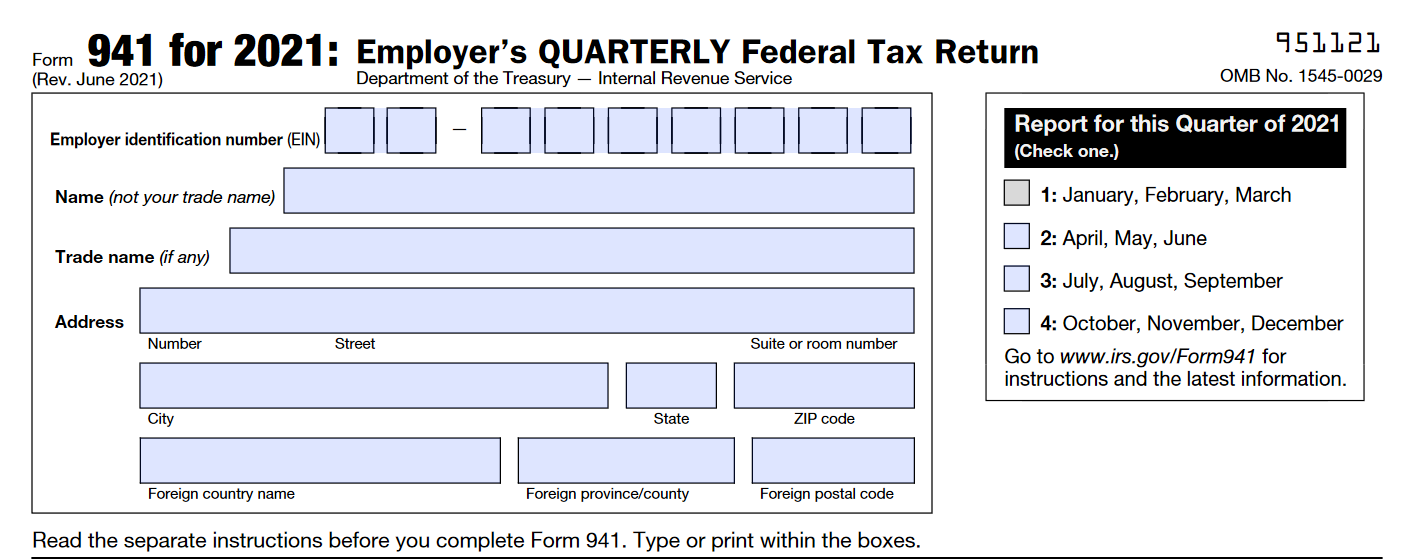

Source: www.expressefile.com

Source: www.expressefile.com

IRS Form 941 Instructions for 2021 How to fill out Form 941, There are several updates to note for the 2024 q1 form 941. Previously set at $160,200 in 2023,.

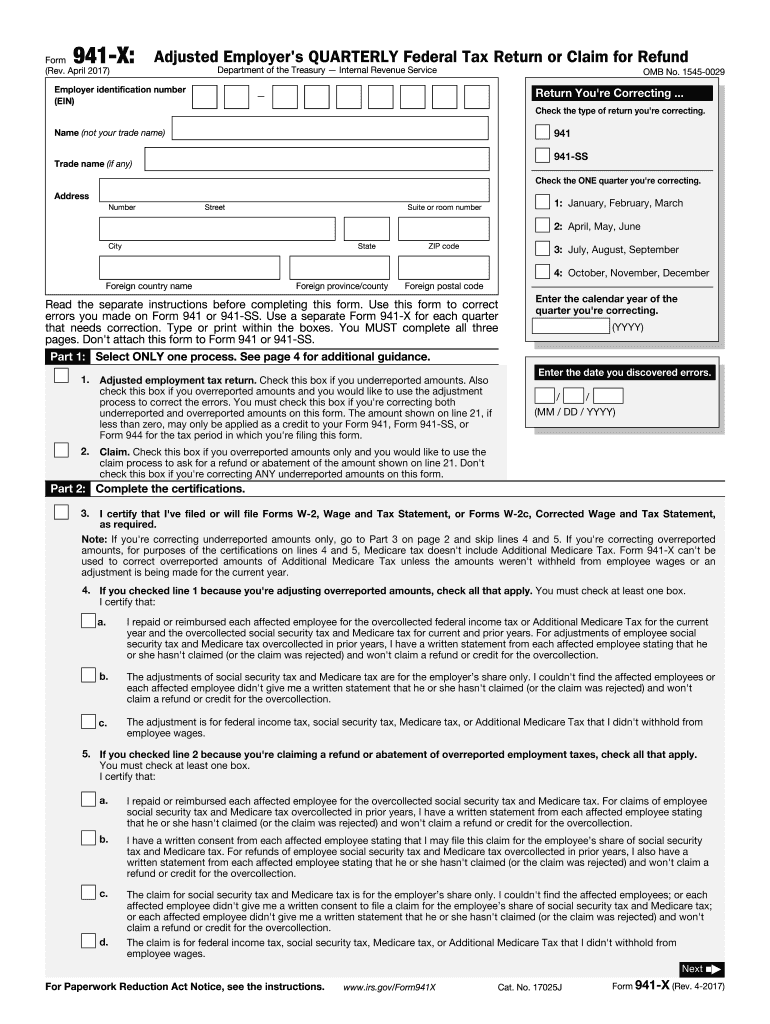

Source: www.signnow.com

Source: www.signnow.com

Irs S 941 20172024 Form Fill Out and Sign Printable PDF Template, This guide provides the basics of the 941. File schedule b for form 941 with ease for this tax season.

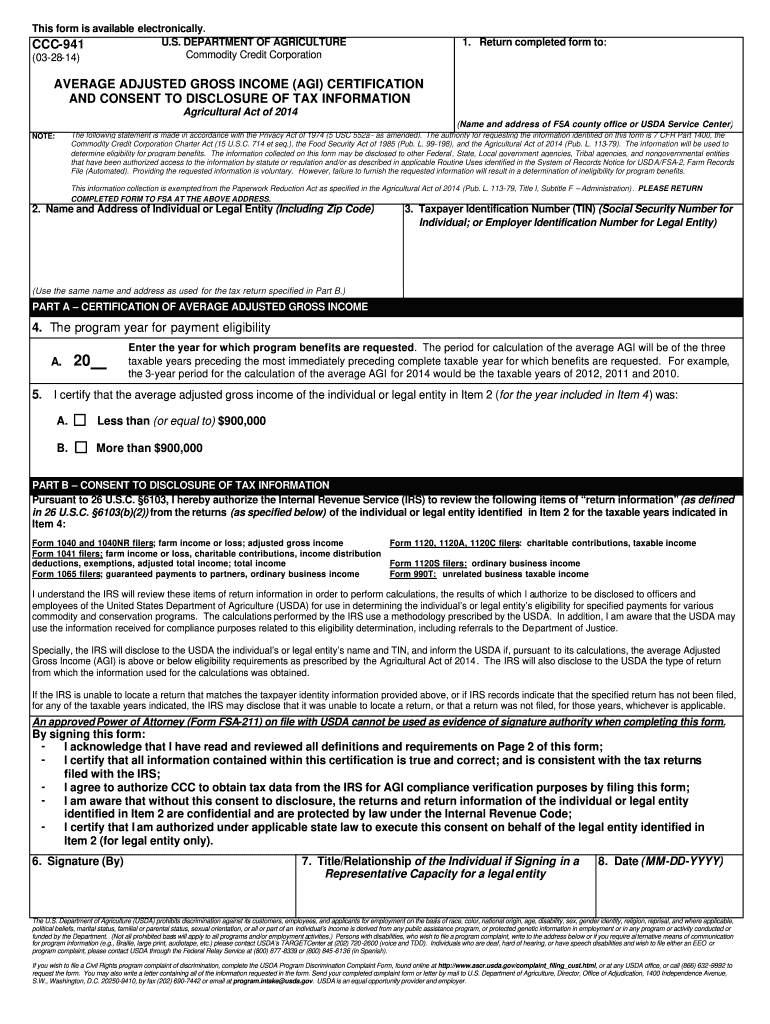

Source: www.signnow.com

Source: www.signnow.com

Ccc 941 20142024 Form Fill Out and Sign Printable PDF Template signNow, Form 1040/1040sr schedule c or f: When are the form 941 deadlines for the 2024 tax year?

Source: fillableforms.net

Source: fillableforms.net

941 X Worksheet 2 Fillable Form Fillable Form 2024, 26 by the internal revenue service. Social security wage limit updated.

Source: blog.taxbandits.com

Source: blog.taxbandits.com

What’s New on IRS Form 941 for Q1 of 2023? Blog TaxBandits, Irs form 941, employer’s quarterly federal tax return, reports payroll taxes and employee wages to the irs. Find out irs changes in quarterly tax form 941 for ty 2024.

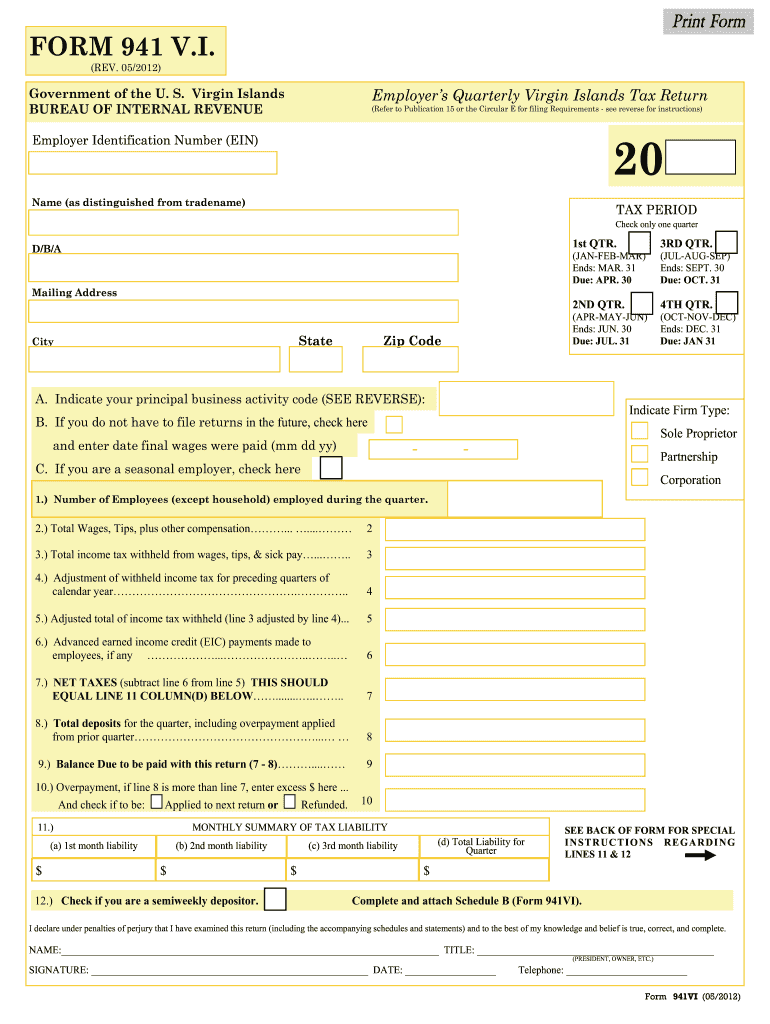

Source: www.signnow.com

Source: www.signnow.com

941 V I 20122024 Form Fill Out and Sign Printable PDF Template, Social security wage limit updated. To determine if you’re a semiweekly schedule depositor, see section 11 of pub.

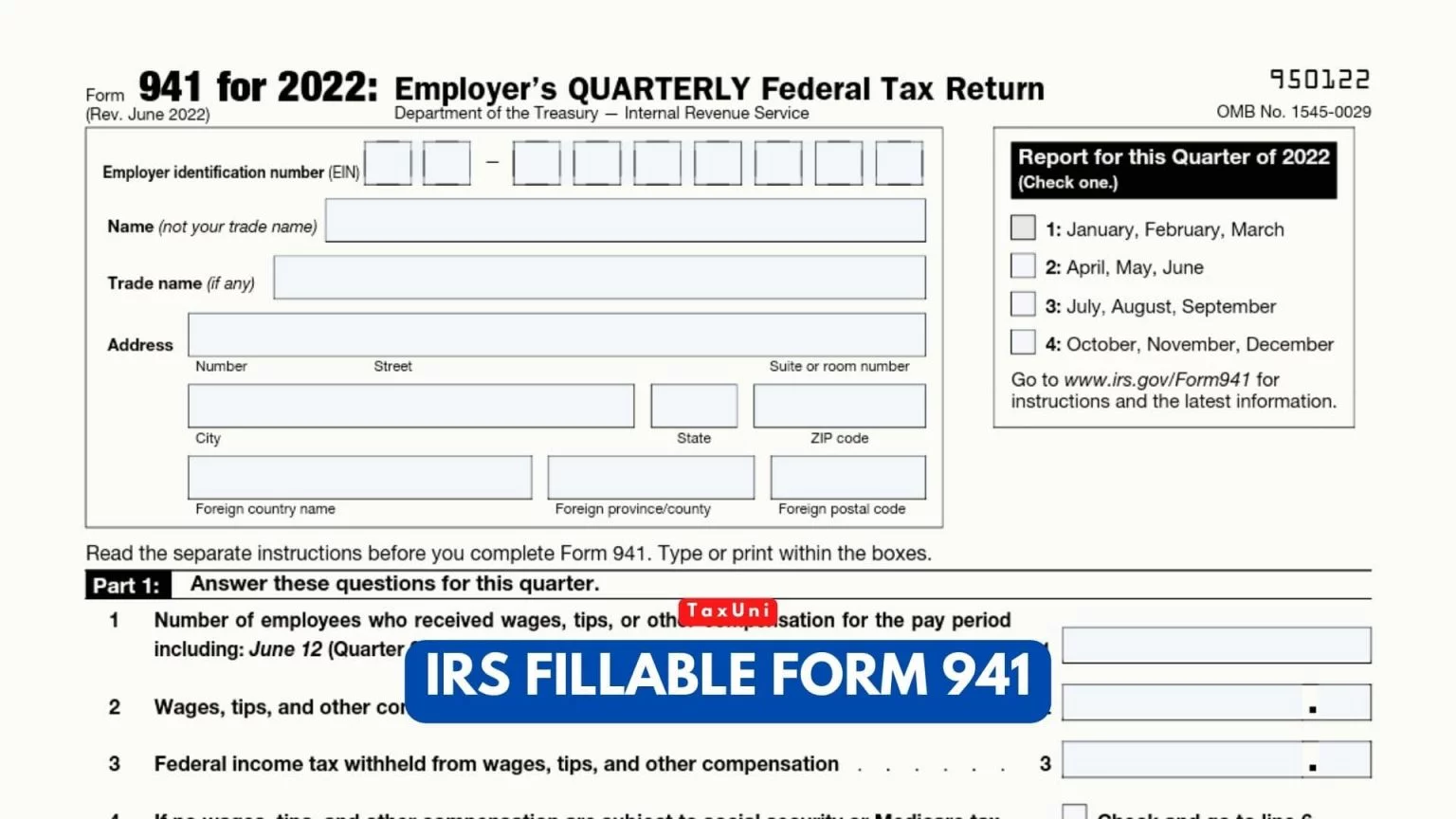

Source: www.taxuni.com

Source: www.taxuni.com

IRS Fillable Form 941 2023, Draft instructions for form 941 and its schedules to be used for all four quarters of 2024 were released jan. This guide provides the basics of the 941.

:max_bytes(150000):strip_icc()/Screenshot41-609c5062555746a19a271903137d39a0.png) Source: www.thebalancemoney.com

Source: www.thebalancemoney.com

IRS Form 941 What Is It?, The following changes are made for the 2024 tax year:. Irs releases 2024 form 941 schedule b:

Source: www.boomtax.com

Source: www.boomtax.com

2024 IRS Form 941 Employer's QuarterbyQuarter Federal Tax Filing, Social security and medicare tax base increase: Most businesses must report and file tax returns quarterly using the irs form 941.

Most Businesses Must Report And File Tax Returns Quarterly Using The Irs Form 941.

The 941 deadlines for the 2024 tax year are as follows:

The Draft Form 941, Employer’s.

File schedule b for form 941 with ease for this tax season.