Backdoor Roth Ira Contribution Limits 2024 2024

This is the entire amount that you can put into all of your iras combined. The maximum contribution limit for both types of.

Some minor gained interest also to deal with here to complicate things. Roth ira income and contribution limits.

Can That Backdoor Roth Conversion Still Be Counted Towards My 2023 Roth Ira Contribution Limit, Or Would It Be Shifted Into My 2024 Contribution Limit, Meaning I Missed My 2023 Contribution?

The roth ira contribution limit for 2024 is $7,000 for those under 50 and up to $8,000 for those 50 or older.

In 2024, The Contribution Limits Rise To $7,000, Or $8,000 For Those 50 And Older.

The maximum contribution limit for roth and traditional iras for 2024 is:

Images References :

Source: aletheawdode.pages.dev

Source: aletheawdode.pages.dev

Roth Ira Contribution Limits 2024 Over 50 Years Of Age Edith Heloise, If your modified adjusted gross income (magi)*** for the calendar year ending december 31st 2024 is going to be above the 2024 irs upper income limits which are $161k for a single filer and $240k total of the two magis for those filing jointly, then you are not permitted to make a direct contribution to a roth ira for that year and will face. For 2024, you can contribute to a roth ira.

Source: clemqlezlie.pages.dev

Source: clemqlezlie.pages.dev

Roth Ira Limits 2024 Helena Aloysia, For 2024, the income limit for roth iras is $161,000 for single filers and $240,000 for married individuals filing jointly. So, for example, using the 2024 amounts, which are $7,000 and $1,000, or.

Source: www.mymoneydesign.com

Source: www.mymoneydesign.com

Roth IRA Contribution Limits and Using the Backdoor Conversion, How does a backdoor roth ira work? Contribute the max for year 2023 and convert before april 15th of 2024?

Source: lisaqchristie.pages.dev

Source: lisaqchristie.pages.dev

Ira Limits 2024 Mufi Tabina, How does a backdoor roth ira work? Can that backdoor roth conversion still be counted towards my 2023 roth ira contribution limit, or would it be shifted into my 2024 contribution limit, meaning i missed my 2023 contribution?

Source: www.advantaira.com

Source: www.advantaira.com

2024 Contribution Limits Announced by the IRS, So, for example, using the 2024 amounts, which are $7,000 and $1,000, or. A step by step guide that shows you how to successfully complete a backdoor roth ira contribution via vanguard in 2023 (for a mutual fund or brokerage ira).

Source: us.firenews.video

Source: us.firenews.video

Roth IRA Contribution Limit 2024 2024 Roth IRA Contribution Limits in, Between $146,000 and $161,000 for single filers. The roth ira contribution limit for 2024 is $7,000 for those under 50 and up to $8,000 for those 50 or older.

Source: madimanagesmoney.com

Source: madimanagesmoney.com

How to Do a Backdoor Roth IRA Contribution, Traditional iras can give you an immediate tax break on your contribution, your money grows. I typically perform a backdoor roth (both the contribution to the traditional ira and the conversion to a roth) before december 31st of the tax year.

Source: rothirachick.com

Source: rothirachick.com

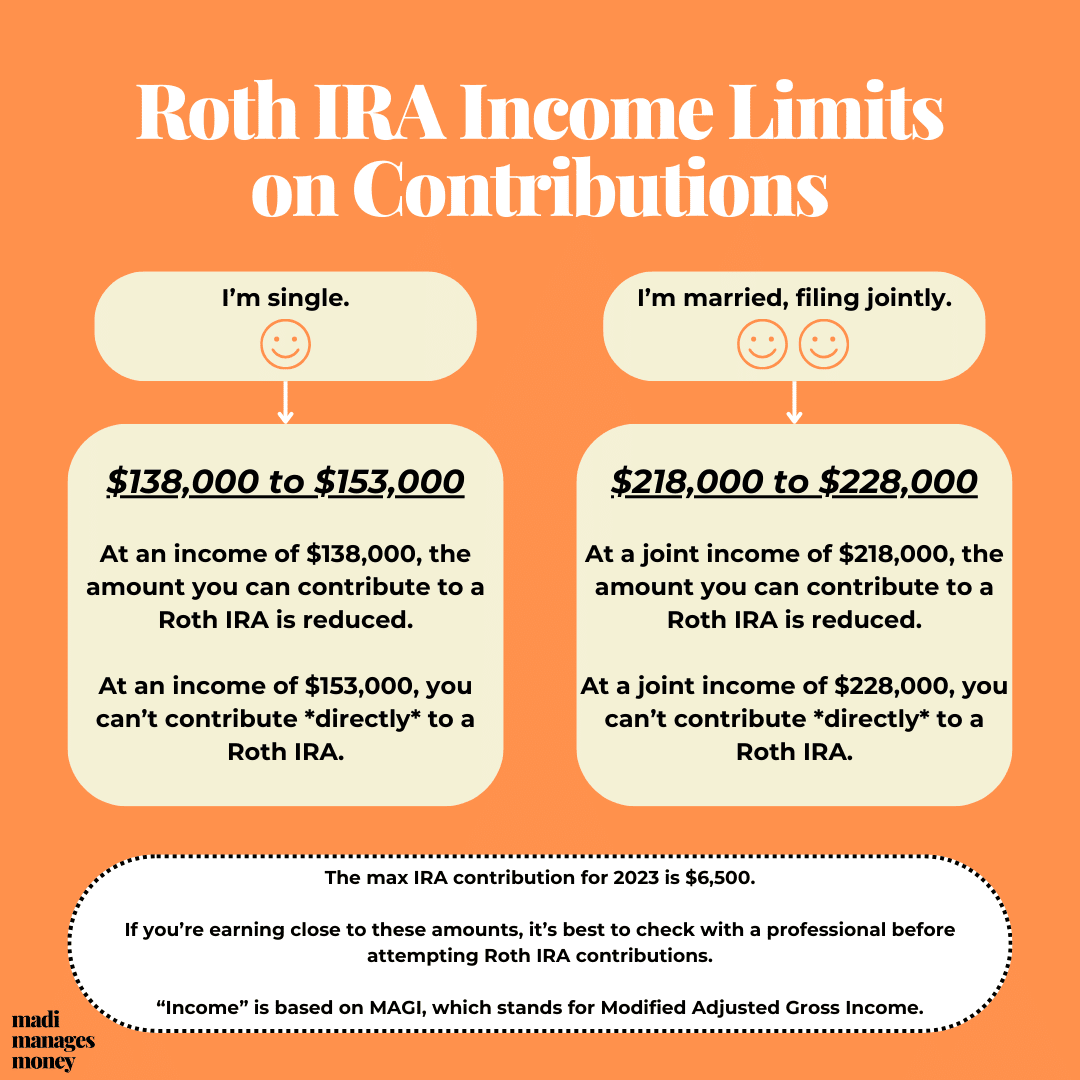

Your Roth IRA Contribution Limits Backdoor Strategies, Between $138,000 and $153,000 for single filers and between $218,000 and $228,000 for joint filers. The contribution limit for 2024 is $7,000 ($8,000 if you’re age 50 or older).

Source: lauriewgreta.pages.dev

Source: lauriewgreta.pages.dev

Ira Limit For 2024, $7,000 if you're younger than age 50. You can’t contribute more than 100% of your salary, which makes sense.

Source: www.financestrategists.com

Source: www.financestrategists.com

IRA Contribution Limits 2024 Finance Strategists, Here's how those contribution limits stack up for the 2023 and 2024 tax years. Roth ira income and contribution limits.

Can That Backdoor Roth Conversion Still Be Counted Towards My 2023 Roth Ira Contribution Limit, Or Would It Be Shifted Into My 2024 Contribution Limit, Meaning I Missed My 2023 Contribution?

Contribute the max for year 2023 and convert before april 15th of 2024?

A Backdoor Roth Ira May Be Particularly Appealing To Those Who Earn Too Much To Contribute Directly To A Roth Ira.

Taxpayers making more than the $161,000 limit in 2024 can’t contribute to a roth ira, but they can convert other forms of ira accounts into roth ira accounts.

Category: 2024